And that’s only a minuscule sampling. More obscure agencies, such as the recently gutted #CFPB, keep records of corporate trade secrets, #credit reports, #mortgage info, & other sensitive #data, including lists of people who have fallen on financial hardship.

A fragile combination of decades-old laws, norms, & jungly bureaucracy has so far prevented repositories such as these from assembling into a centralized American #surveillance state.

![The Un-insurability Crisis Is Upon Us – 3 Possible Scenarios for What’s Next

Andrew Hoffman, Rupert Read, originally published by Resilience.org, April 15, 2025

Insurers should, through their disclosure and lobbying power, play a key role in achieving a safer and more resilient world. Through disclosure, they can share their vast knowledge about the financial risks of a climate changed world. Through lobbying, they can advocate for a suite of laws and policies that make the world more insurable in the face of the ever-mounting risks.

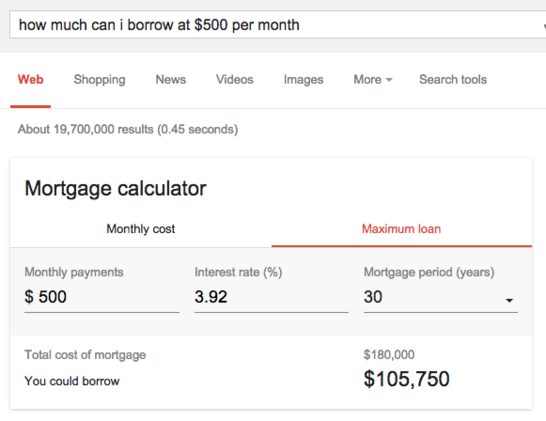

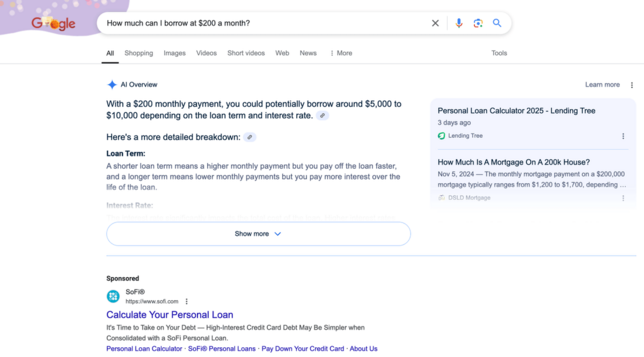

The insurance sector is dealing with the realities of a climate-changed world with higher payouts from more extreme weather events & more assets in harm’s way by raising premiums & reducing coverage to manage losses. As this continues, with an increasing number of regions becoming ‘ uninsurable‘, Fed Reserve Chair Jerome Powell has warned that insurance companies pull out “of coastal areas [and] areas where there are a lot of fires” the loss of available ins means that “there are going to be regions of the country where you can’t get a mortgage” in “10 or 15 years.” This would be devastating to individual homeowners & the economy at large as property values drop & governments take in less tax revenue for schools, police & other basic services. Günther Thallinger, Chair of the Investment Board of multi-national insurance company Allianz SE warns that this represents “a systemic risk that threatens the very foundation of the financial sector.” The Un-insurability Crisis Is Upon Us – 3 Possible Scenarios for What’s Next

Andrew Hoffman, Rupert Read, originally published by Resilience.org, April 15, 2025

Insurers should, through their disclosure and lobbying power, play a key role in achieving a safer and more resilient world. Through disclosure, they can share their vast knowledge about the financial risks of a climate changed world. Through lobbying, they can advocate for a suite of laws and policies that make the world more insurable in the face of the ever-mounting risks.

The insurance sector is dealing with the realities of a climate-changed world with higher payouts from more extreme weather events & more assets in harm’s way by raising premiums & reducing coverage to manage losses. As this continues, with an increasing number of regions becoming ‘ uninsurable‘, Fed Reserve Chair Jerome Powell has warned that insurance companies pull out “of coastal areas [and] areas where there are a lot of fires” the loss of available ins means that “there are going to be regions of the country where you can’t get a mortgage” in “10 or 15 years.” This would be devastating to individual homeowners & the economy at large as property values drop & governments take in less tax revenue for schools, police & other basic services. Günther Thallinger, Chair of the Investment Board of multi-national insurance company Allianz SE warns that this represents “a systemic risk that threatens the very foundation of the financial sector.”](https://media.norden.social/cache/media_attachments/files/114/342/258/426/323/011/small/5ad5a5a2421acd0b.png)