Day 32

Things are coming in thick and fast today, so I’ll try to summarise the major themes.

No Policies of the #Liberal, #LNP and #Coalition.

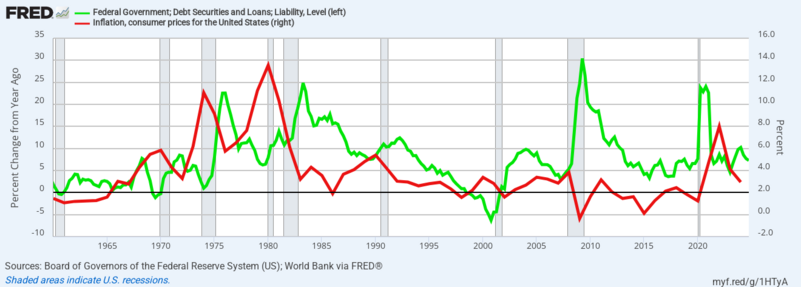

#AngusTaylor (Opposition Treasurer, Liberal) hands in his #Economics homework late, it’s got problems.

A derivative that is toxic

“A Coalition government would drive the #budget deeper into #deficit over the coming two years, as the shadow finance minister, #JaneHume, insisted her party’s plan to save $17.2bn by #slashing the number of #Canberra-based #PublicServants by 41,000 through “natural attrition” was achievable.”

If returned to power, the Coalition would gut a long list of environment and clean energy programs, including #scrapping the #NetZero #Economy #Agency, reversing Labor’s #TaxBreaks for #ElectricVehicles, and redirecting money slated for the #HomeBatteries program.

#Reversing tax incentives for green hydrogen would save $1.5bn over four years, and not proceeding with Labor’s critical mineral production tax credits would save $1.2bn, the Coalition’s election policy costings show.”

#AusPol / #treasury / #costings / #economy / #future <https://www.theguardian.com/australia-news/2025/may/01/coalition-costings-federal-election-promises-larger-deficit-cut-foreign-aid-environment-clean-energy>